Earnings Calendar This Week (Hypothetical – October 2025): Navigating a Shifting Market Panorama

Associated Articles: Earnings Calendar This Week (Hypothetical – October 2025): Navigating a Shifting Market Panorama

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Earnings Calendar This Week (Hypothetical – October 2025): Navigating a Shifting Market Panorama. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Earnings Calendar This Week (Hypothetical – October 2025): Navigating a Shifting Market Panorama

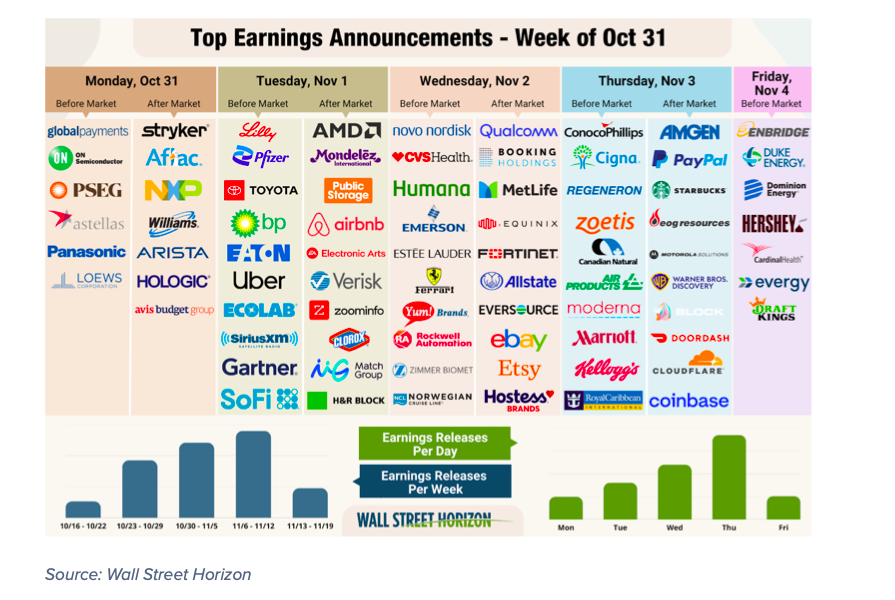

This week’s earnings calendar (October twenty seventh – October thirty first, 2025) guarantees to be a pivotal second for buyers, providing insights into the efficiency of key gamers throughout varied sectors and probably shaping market sentiment within the coming weeks and months. The financial local weather stays dynamic, with ongoing discussions surrounding inflation, rates of interest, and geopolitical instability persevering with to affect company profitability and investor expectations. This text will dissect the important thing earnings bulletins, analyze potential market impacts, and provide methods for navigating the risky panorama.

Expertise Sector: Navigating the AI Revolution

The know-how sector will likely be below intense scrutiny this week, with a number of main gamers releasing their quarterly outcomes. Among the many most anticipated are:

-

Meta Platforms (META): Meta’s earnings will likely be intently watched for indicators of sustained development in its metaverse initiatives and promoting income. Analysts will likely be in search of knowledge on person engagement throughout its varied platforms (Fb, Instagram, WhatsApp) and the effectiveness of its cost-cutting measures. Any indication of slowing development in promoting income, a key driver of profitability, might set off a adverse market response. Moreover, investor sentiment will likely be closely influenced by the corporate’s outlook on the way forward for AI integration inside its platforms and its aggressive panorama in opposition to different tech giants.

-

Nvidia (NVDA): Nvidia, a pacesetter in AI chip know-how, is predicted to report robust earnings, pushed by the continued surge in demand for its high-performance GPUs utilized in AI improvement and knowledge facilities. Nevertheless, the market will likely be scrutinizing the sustainability of this development, contemplating the potential for elevated competitors and the potential for a slowdown within the total AI market. Any indication of weakening demand or provide chain constraints might negatively affect investor confidence.

-

Amazon (AMZN): Amazon’s earnings will reveal the well being of its e-commerce enterprise, cloud computing (AWS), and promoting segments. Buyers will likely be eager to see the affect of inflation on shopper spending and the corporate’s potential to take care of its market share in a aggressive panorama. The efficiency of AWS, a serious development driver, will likely be notably vital, as will any updates on Amazon’s ongoing investments in AI and automation.

Shopper Discretionary Sector: Gauging Shopper Sentiment

The patron discretionary sector, a barometer of shopper confidence, will provide invaluable insights into the well being of the broader economic system. Key gamers releasing earnings this week embody:

-

Nike (NKE): Nike’s earnings will likely be a vital indicator of shopper spending on attire and footwear. Analysts will likely be specializing in gross sales development, margins, and stock ranges. Any indicators of weakening shopper demand or elevated promotional exercise might sign broader financial considerations. The corporate’s technique to navigate provide chain disruptions and compete with rising manufacturers may also be below scrutiny.

-

Residence Depot (HD): Residence Depot’s efficiency will mirror the state of the housing market and shopper spending on residence enchancment tasks. The corporate’s earnings will likely be intently watched for indicators of a slowdown within the housing market, which might affect future development prospects. Analysts will likely be inspecting gross sales tendencies, margins, and the corporate’s outlook on the way forward for the housing market.

-

Starbucks (SBUX): Starbucks’ earnings will present insights into shopper spending on premium espresso and the corporate’s potential to handle rising prices. Buyers will likely be in search of updates on same-store gross sales development, visitors tendencies, and the corporate’s pricing technique. The affect of inflation on shopper spending and the corporate’s potential to take care of its premium positioning will likely be essential elements.

Power Sector: Navigating Geopolitical Uncertainty

The vitality sector, extremely delicate to geopolitical occasions and commodity costs, will likely be one other focus this week. Key gamers embody:

-

ExxonMobil (XOM): ExxonMobil’s earnings will mirror the affect of fluctuating oil costs and world demand on the corporate’s profitability. Buyers will likely be intently watching the corporate’s manufacturing ranges, margins, and capital expenditure plans. Geopolitical occasions and the transition to renewable vitality sources will proceed to play a big position in shaping investor sentiment.

-

Chevron (CVX): Just like ExxonMobil, Chevron’s earnings will likely be closely influenced by oil costs and world demand. Buyers will likely be assessing the corporate’s potential to handle prices and capitalize on alternatives in a risky market. The corporate’s technique for investing in renewable vitality may also be a key space of focus.

Monetary Sector: Assessing Curiosity Fee Impacts

The monetary sector, notably banks, will likely be intently watched for indicators of how they’re navigating the present rate of interest atmosphere. Key gamers reporting this week (hypothetically) would possibly embody:

- JPMorgan Chase (JPM): JPMorgan Chase’s earnings will present insights into the well being of the banking sector and the affect of rate of interest hikes on lending and profitability. Analysts will likely be scrutinizing web curiosity margins, mortgage development, and credit score high quality. The corporate’s outlook on the broader economic system and its potential to handle dangers will likely be essential elements.

Methods for Navigating the Earnings Season

Navigating this week’s earnings season requires a cautious and knowledgeable strategy. Listed here are some key methods:

-

Diversification: Unfold your investments throughout totally different sectors and asset lessons to mitigate danger. Do not over-concentrate in any single sector or firm.

-

Elementary Evaluation: Conduct thorough due diligence on firms earlier than investing. Analyze their monetary statements, enterprise fashions, and aggressive panorama.

-

Technical Evaluation: Use technical indicators to establish potential entry and exit factors. Nevertheless, keep in mind that technical evaluation must be used at the side of elementary evaluation.

-

Threat Administration: Develop a transparent danger administration plan and stick with it. Keep away from emotional decision-making and set stop-loss orders to guard your investments.

-

Lengthy-Time period Perspective: Deal with the long-term development potential of firms slightly than short-term market fluctuations. Earnings reviews might be risky, however the long-term worth of an organization is usually extra vital.

-

Keep Knowledgeable: Keep up to date on market information and financial indicators. Comply with respected monetary information sources and seek the advice of with a monetary advisor if wanted.

Disclaimer: This text is for informational functions solely and doesn’t represent monetary recommendation. Investing entails danger, and you possibly can lose cash. At all times conduct your personal analysis and seek the advice of with a monetary advisor earlier than making any funding choices. The businesses and dates talked about are hypothetical examples for illustrative functions within the context of a 2025 earnings season and don’t mirror precise reporting schedules.

Closure

Thus, we hope this text has supplied invaluable insights into Earnings Calendar This Week (Hypothetical – October 2025): Navigating a Shifting Market Panorama. We thanks for taking the time to learn this text. See you in our subsequent article!