Mastering Your Funds: A Complete Information to Bi-Weekly Pay Interval Calendars for 2025

Associated Articles: Mastering Your Funds: A Complete Information to Bi-Weekly Pay Interval Calendars for 2025

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering Your Funds: A Complete Information to Bi-Weekly Pay Interval Calendars for 2025. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Mastering Your Funds: A Complete Information to Bi-Weekly Pay Interval Calendars for 2025

The 12 months 2025 is quick approaching, and with it comes the necessity to arrange your monetary life. For a lot of, this implies understanding and using a bi-weekly pay interval calendar. In contrast to month-to-month or weekly pay cycles, bi-weekly pay presents distinctive challenges and alternatives for budgeting and monetary planning. This complete information will delve into the intricacies of bi-weekly pay, give you a customizable 2025 template, and provide sensible methods to maximise your monetary well-being.

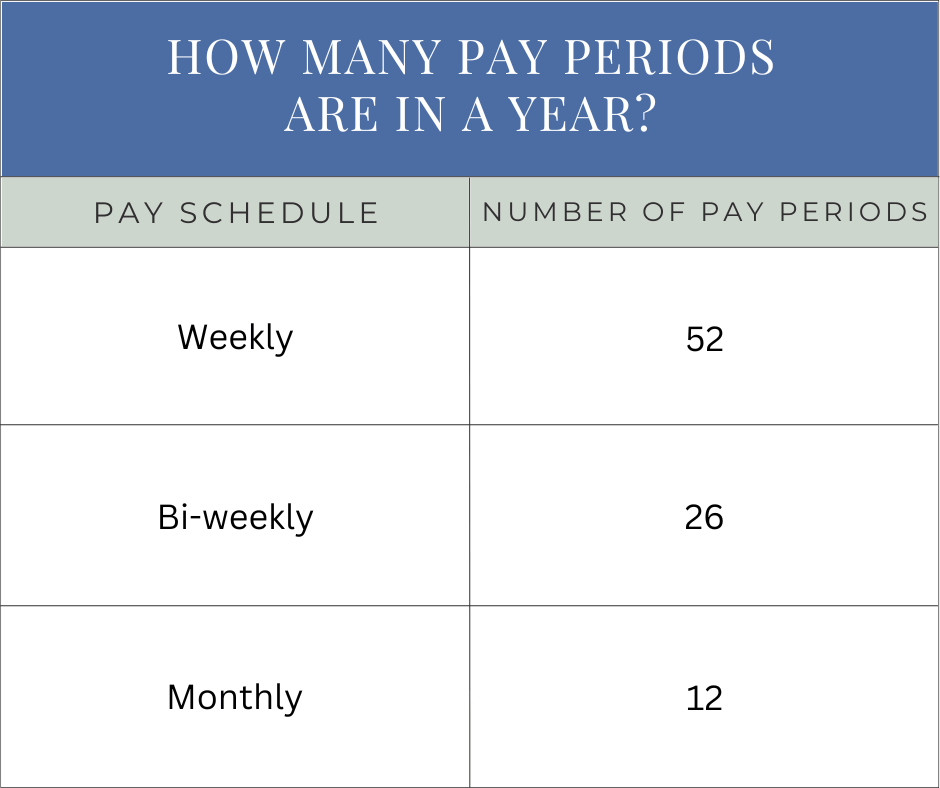

Understanding Bi-Weekly Pay Intervals

A bi-weekly pay interval means you obtain your wage each two weeks. This interprets to 26 paychecks per 12 months, in contrast to the 24 paychecks you’d obtain with a semi-monthly schedule (twice a month). This seemingly small distinction can considerably influence your budgeting and financial savings methods.

Benefits of Bi-Weekly Pay:

- Extra Frequent Earnings: The extra frequent revenue stream can ease money circulation considerations and scale back the chance of overspending earlier than your subsequent paycheck arrives. That is notably useful for managing surprising bills.

- Improved Budgeting Management: With extra frequent paychecks, you’ll be able to extra successfully observe your spending and regulate your price range accordingly. This enables for faster identification of overspending areas and sooner course correction.

- Sooner Debt Reimbursement: The elevated frequency of revenue can speed up debt reimbursement, as you may have extra alternatives to make funds all year long.

- Enhanced Financial savings Potential: With extra frequent revenue, you’ll be able to allocate smaller quantities to financial savings extra persistently, resulting in probably larger financial savings in the long term.

Disadvantages of Bi-Weekly Pay:

- Inconsistent Month-to-month Earnings: The variety of days in every pay interval varies, leading to barely completely different web pay quantities every month. This inconsistency could make month-to-month budgeting barely extra complicated.

- Diversified Tax Withholding: Tax withholding might not completely align together with your precise annual revenue tax legal responsibility, probably resulting in both overpayment or underpayment of taxes. This requires cautious tax planning.

- Challenges with Month-to-month Invoice Funds: Matching your bi-weekly pay schedule with month-to-month payments can require cautious planning to make sure well timed funds.

Creating Your 2025 Bi-Weekly Pay Interval Calendar Template:

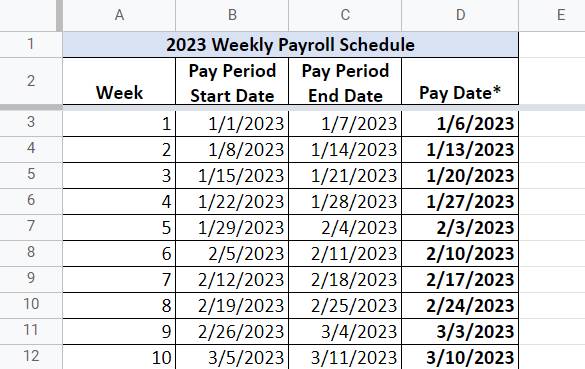

The important thing to successfully managing your funds with a bi-weekly pay schedule is to have a well-organized calendar. Here is how one can create a customizable template for 2025:

1. Decide Your Payday:

First, determine your particular payday. Is it all the time on a Friday? A Monday? Figuring out that is essential for correct calendar creation.

2. Select a Calendar Format:

You’ll be able to create your calendar utilizing numerous strategies:

- Spreadsheet Software program (Excel, Google Sheets): Provides flexibility and permits for calculations and formulation to automate sure points of your price range.

- Calendar Utility (Google Calendar, Outlook Calendar): Permits for visible illustration and reminders for payday and invoice funds.

- Printable Template: Quite a few free printable templates can be found on-line, permitting for a extra hands-on strategy.

3. Populate the Calendar:

As soon as you’ve got chosen your format, begin populating it together with your paydays for 2025. Keep in mind, there are 26 bi-weekly pay durations in a 12 months. Begin together with your first payday in 2025 and add two weeks to find out the following payday, and so forth.

Instance (Illustrative – Modify to your particular payday):

Let’s assume your first payday in 2025 is January third (Friday). Your subsequent paydays can be:

- January seventeenth

- January thirty first

- February 14th

- February twenty eighth

- March 14th

- …and so forth.

4. Incorporate Invoice Funds:

Subsequent, add your recurring invoice funds to the calendar. It will show you how to visualize when funds are due and guarantee you may have ample funds obtainable. Use completely different colours or symbols to differentiate between various kinds of payments (lease, utilities, bank cards, and many others.).

5. Add Financial savings Targets:

Combine your financial savings targets into the calendar. Resolve how a lot you need to save every pay interval and schedule computerized transfers to your financial savings account in your payday.

6. Monitor Bills:

Embrace a piece in your calendar or spreadsheet to trace your bills. This might be a easy each day or weekly log, permitting you to watch spending in opposition to your price range.

7. Customise and Refine:

This template is a place to begin. Customise it primarily based in your particular wants and preferences. Add notes, reminders, and every other related data to make it a very efficient monetary administration device.

Superior Methods for Bi-Weekly Pay:

- Budgeting Methods: Make use of budgeting strategies just like the 50/30/20 rule (50% wants, 30% desires, 20% financial savings and debt reimbursement) to allocate your revenue successfully.

- Zero-Primarily based Budgeting: Allocate each greenback of your revenue to a selected class, making certain that every one your revenue is accounted for.

- Envelope System: Allocate money for particular classes into separate envelopes to visually observe spending.

- Automated Financial savings: Arrange computerized transfers to your financial savings and funding accounts to make sure constant financial savings.

- Debt Administration Methods: Make the most of debt reimbursement strategies just like the debt snowball or debt avalanche to prioritize and speed up debt reimbursement.

Software program and Apps for Bi-Weekly Pay Administration:

Quite a few software program purposes and cellular apps can help in managing your bi-weekly pay and funds. These instruments typically present options resembling:

- Budgeting and Expense Monitoring: Permit you to enter your revenue and bills, observe your spending, and create budgets.

- Invoice Cost Reminders: Ship reminders for upcoming invoice funds to forestall late charges.

- Financial savings Aim Setting: Assist you set financial savings targets and observe your progress.

- Debt Administration Instruments: Present instruments to handle and observe your money owed.

Conclusion:

Mastering your funds with a bi-weekly pay schedule requires group, planning, and the fitting instruments. By making a custom-made 2025 bi-weekly pay interval calendar and implementing efficient budgeting methods, you’ll be able to achieve management of your funds, obtain your financial savings targets, and construct a robust monetary basis for the longer term. Keep in mind to recurrently overview and regulate your calendar and price range to make sure they continue to be related and efficient all year long. The important thing to success lies in constant monitoring, adaptation, and a proactive strategy to monetary administration. Do not wait – begin creating your 2025 bi-weekly pay calendar immediately!

Closure

Thus, we hope this text has supplied helpful insights into Mastering Your Funds: A Complete Information to Bi-Weekly Pay Interval Calendars for 2025. We hope you discover this text informative and helpful. See you in our subsequent article!