Navigating the 2025 Bi-Month-to-month Payroll Calendar: A Complete Information for Employers and Workers

Associated Articles: Navigating the 2025 Bi-Month-to-month Payroll Calendar: A Complete Information for Employers and Workers

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Navigating the 2025 Bi-Month-to-month Payroll Calendar: A Complete Information for Employers and Workers. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Navigating the 2025 Bi-Month-to-month Payroll Calendar: A Complete Information for Employers and Workers

The environment friendly and correct processing of payroll is essential for any group, no matter measurement. A well-structured payroll calendar is the spine of this course of, making certain well timed funds and minimizing potential errors. For companies working on a bi-monthly payroll schedule, understanding and using a devoted calendar for 2025 is paramount. This text gives a complete information to navigating the 2025 bi-monthly payroll calendar, providing insights for each employers and staff.

Understanding Bi-Month-to-month Payroll

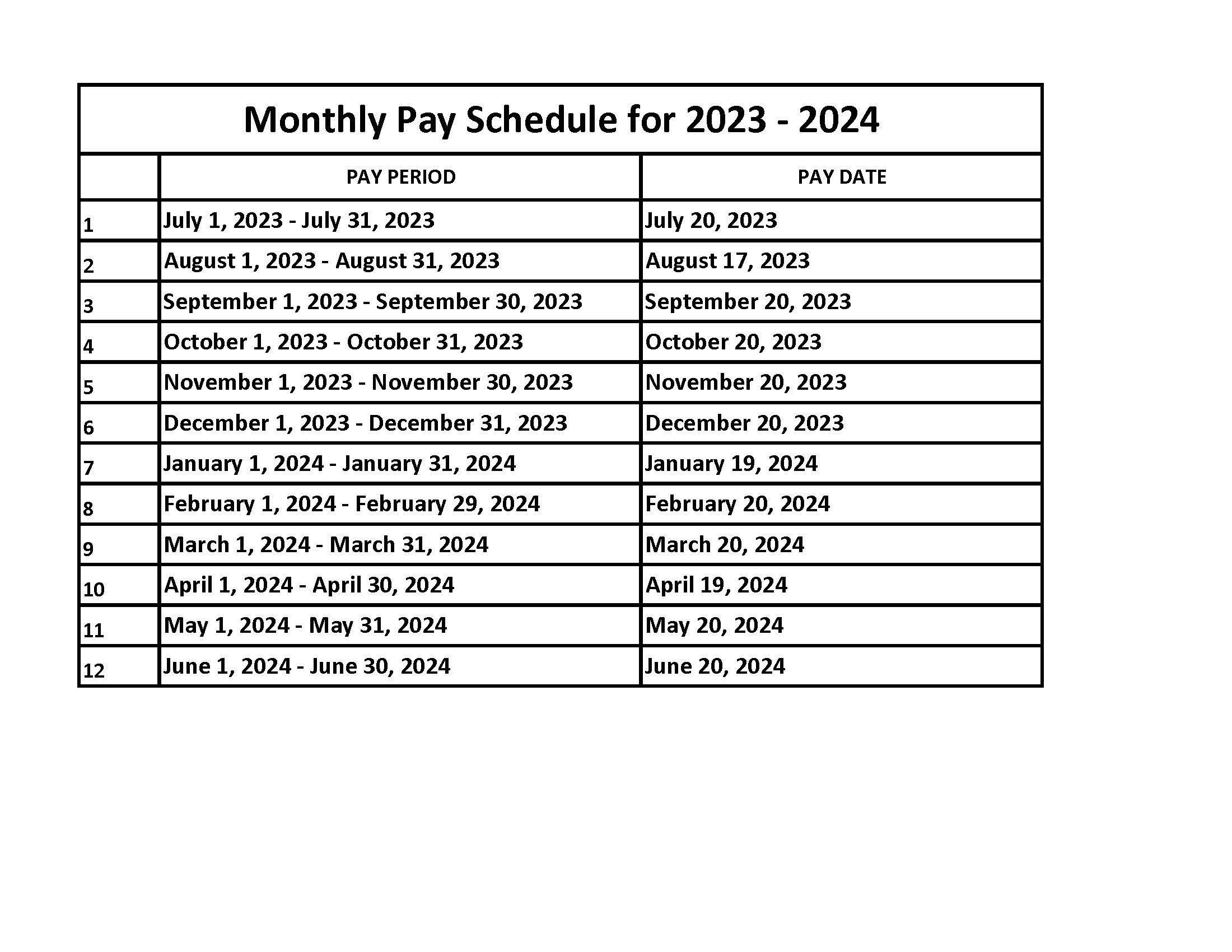

Bi-monthly payroll means staff are paid twice a month, usually on a set schedule, such because the fifteenth and the final day of the month, or two different persistently scheduled days. This contrasts with semi-monthly payroll, which includes two pay durations per thirty days, however the actual dates shift barely relying on the month’s size. The important thing distinction lies within the consistency of fee dates in a bi-monthly system.

Making a 2025 Bi-Month-to-month Payroll Calendar

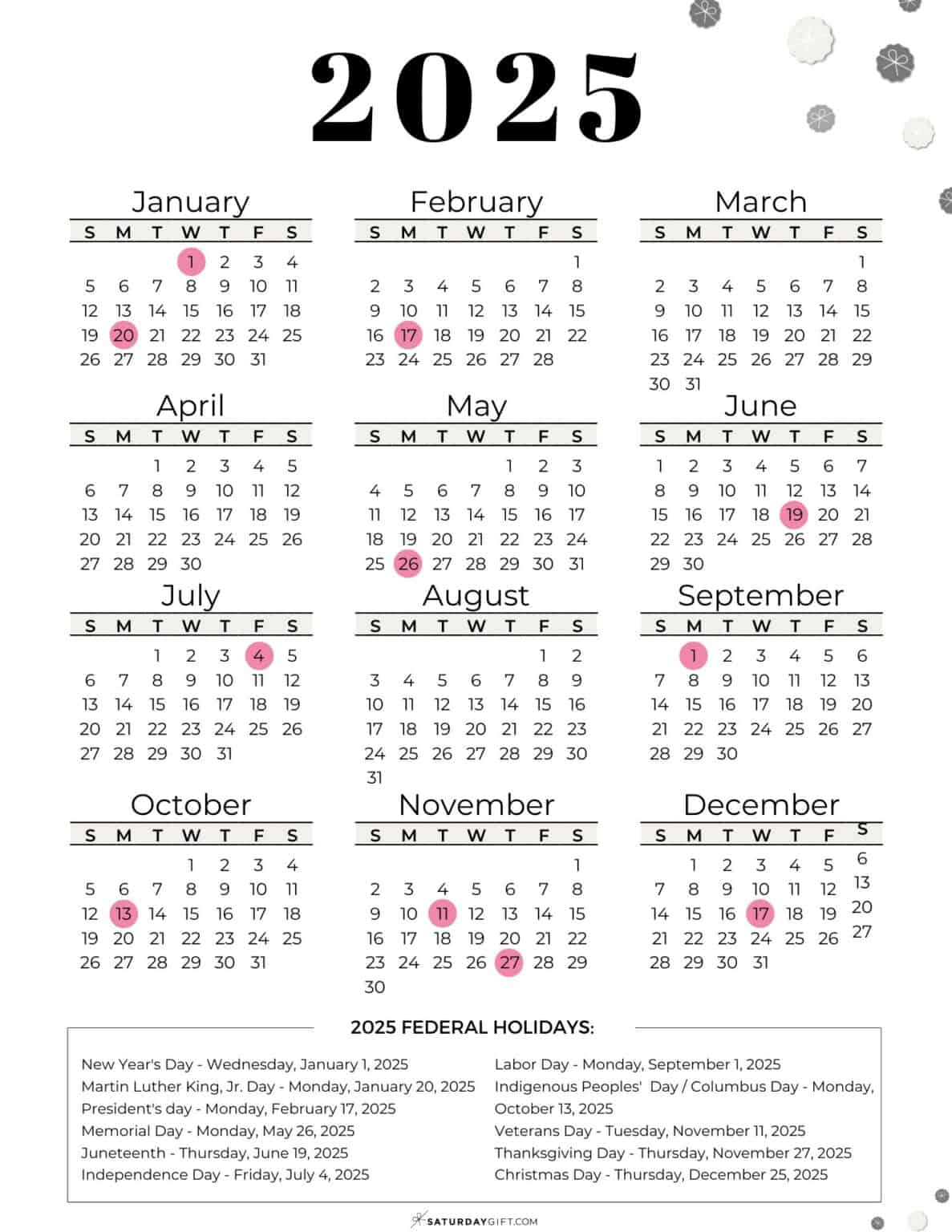

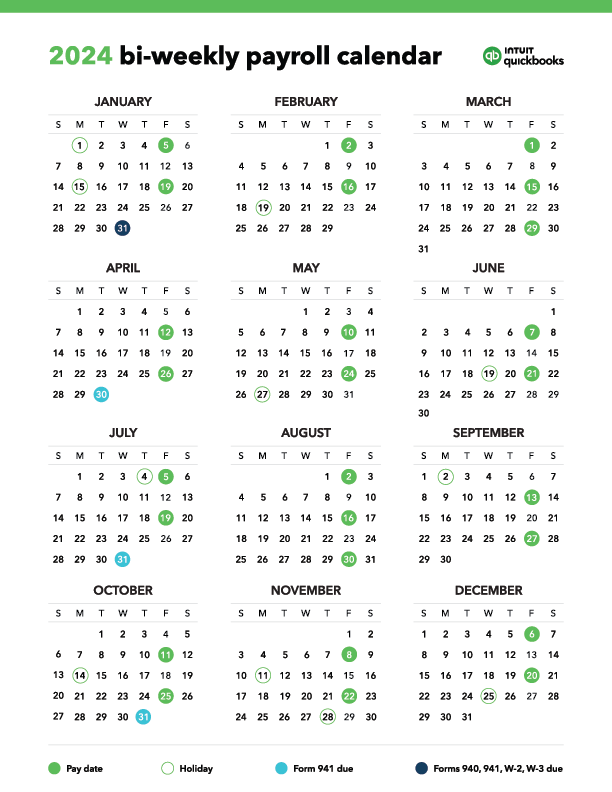

Whereas a pre-made, universally relevant 2025 bi-monthly payroll calendar would not exist (as the particular paydays are decided by the employer), we are able to define the method of making one and spotlight essential issues. Step one is to ascertain the 2 constant fee dates. Widespread decisions embrace:

- 1st and fifteenth: This gives a transparent and predictable schedule.

- fifteenth and final day of the month: This additionally affords a structured strategy, although the final day varies month-to-month.

- Different constant dates: Employers would possibly select dates that align with their accounting cycles or different inner processes.

As soon as the fee dates are chosen, establishing the calendar includes noting these dates for every month of 2025. This may be accomplished manually utilizing a spreadsheet or calendar software program, or through the use of specialised payroll software program that robotically generates pay schedules.

Instance 2025 Bi-Month-to-month Payroll Calendar (fifteenth and Final Day):

(Notice: It is a pattern calendar. The precise pay durations ought to mirror the employer’s chosen paydays. At all times confirm together with your employer for correct dates.)

| Month | Payday 1 (fifteenth) | Payday 2 (Final Day) |

|---|---|---|

| January | January fifteenth | January thirty first |

| February | February fifteenth | February twenty eighth |

| March | March fifteenth | March thirty first |

| April | April fifteenth | April thirtieth |

| Might | Might fifteenth | Might thirty first |

| June | June fifteenth | June thirtieth |

| July | July fifteenth | July thirty first |

| August | August fifteenth | August thirty first |

| September | September fifteenth | September thirtieth |

| October | October fifteenth | October thirty first |

| November | November fifteenth | November thirtieth |

| December | December fifteenth | December thirty first |

Key Concerns for Employers:

- Payroll Software program: Using payroll software program is very really useful. It automates many features of payroll processing, together with producing pay schedules, calculating taxes, and producing pay stubs.

- Correct Report Conserving: Sustaining meticulous data of worker hours, deductions, and funds is essential for compliance and correct reporting.

- Tax Compliance: Employers should perceive and adjust to all related federal, state, and native tax legal guidelines relating to payroll deductions and reporting. This consists of withholding earnings tax, Social Safety tax, Medicare tax, and some other relevant taxes.

- Vacation Pay: The calendar ought to account for holidays. Will staff be paid for holidays? If that’s the case, how will this be mirrored within the payroll schedule?

- Communication: Clearly talk the payroll schedule to staff, ideally effectively prematurely of the brand new 12 months.

- Yr-Finish Processing: Put together for year-end payroll processing, together with W-2 preparation and distribution.

Key Concerns for Workers:

- Understanding Your Pay Schedule: Affirm your bi-monthly paydays together with your employer.

- Budgeting: A constant bi-monthly fee schedule facilitates higher budgeting and monetary planning.

- Monitoring Earnings: Maintain monitor of your earnings and deductions all year long.

- Addressing Discrepancies: Report any discrepancies in your paychecks promptly to your employer’s payroll division.

- Tax Planning: Understanding your payroll schedule helps in planning for annual tax obligations.

Addressing Potential Challenges:

- Month-Finish Changes: For pay durations that span throughout month-ends, guarantee correct allocation of hours and funds.

- Vacation Pay: Make clear the employer’s coverage on vacation pay and the way it impacts the payroll schedule.

- System Errors: Often evaluate pay stubs for accuracy and report any errors instantly.

- Modifications in Employment: Perceive how adjustments in employment standing, equivalent to wage changes or adjustments in tax withholdings, have an effect on your bi-monthly paychecks.

Using Know-how for Payroll Administration:

Fashionable payroll programs provide a wide range of options designed to streamline the method:

- Automated Calculations: Software program automates the calculation of gross pay, deductions, and web pay.

- Direct Deposit: Direct deposit simplifies fee distribution and reduces administrative overhead.

- Reporting and Analytics: Payroll software program gives detailed experiences and analytics, providing worthwhile insights into payroll prices and traits.

- Integration with Different Methods: Many programs combine with HR and accounting software program, streamlining knowledge movement and decreasing guide knowledge entry.

Conclusion:

A well-planned 2025 bi-monthly payroll calendar is crucial for each employers and staff. Employers should prioritize accuracy, compliance, and clear communication. Workers ought to familiarize themselves with their pay schedule and promptly deal with any discrepancies. Leveraging payroll software program and sustaining meticulous data are essential for making certain a easy and environment friendly payroll course of all year long. By understanding and using the ideas outlined on this information, organizations can navigate the 2025 bi-monthly payroll calendar successfully, fostering a constructive and productive work surroundings. Keep in mind to all the time confirm the particular paydays together with your employer, as this information serves as a framework and never a definitive calendar.

Closure

Thus, we hope this text has offered worthwhile insights into Navigating the 2025 Bi-Month-to-month Payroll Calendar: A Complete Information for Employers and Workers. We thanks for taking the time to learn this text. See you in our subsequent article!