Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Staff

Associated Articles: Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Staff

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Staff. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Staff

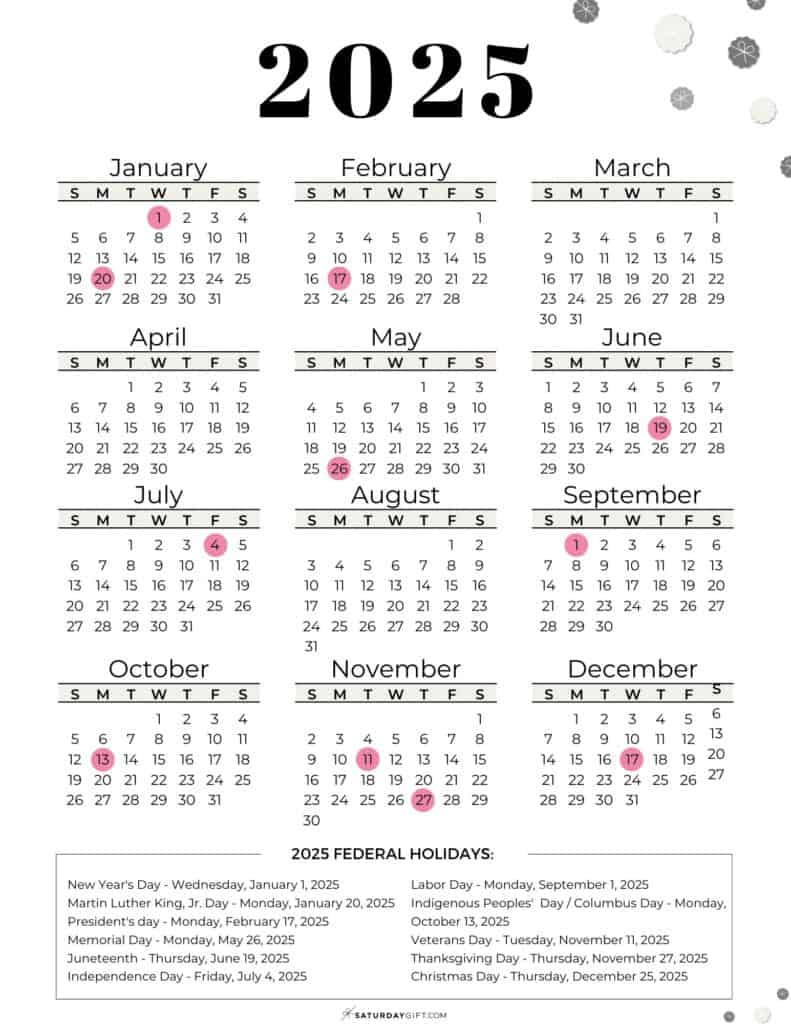

The 12 months 2025 is quick approaching, and with it comes the necessity for cautious planning, particularly regarding payroll. For companies working on a bi-weekly payroll schedule, understanding the exact fee dates is essential for clean monetary operations and worker satisfaction. This complete information gives an in depth breakdown of a possible 2025 bi-weekly payroll calendar, highlighting key concerns for each employers and staff. Whereas particular dates will rely on the chosen place to begin and any company-specific changes, this text provides a framework and helpful insights for navigating the complexities of bi-weekly payroll.

Understanding the Bi-Weekly Payroll System:

A bi-weekly payroll system means staff are paid twice a month, sometimes each two weeks. This differs from semi-monthly payroll, which entails two funds monthly, however on fastened dates (e.g., the fifteenth and the final day of the month). The benefit of bi-weekly pay is the constant frequency, providing staff a predictable earnings stream. Nevertheless, the precise dates shift all year long because of the various variety of days in every month.

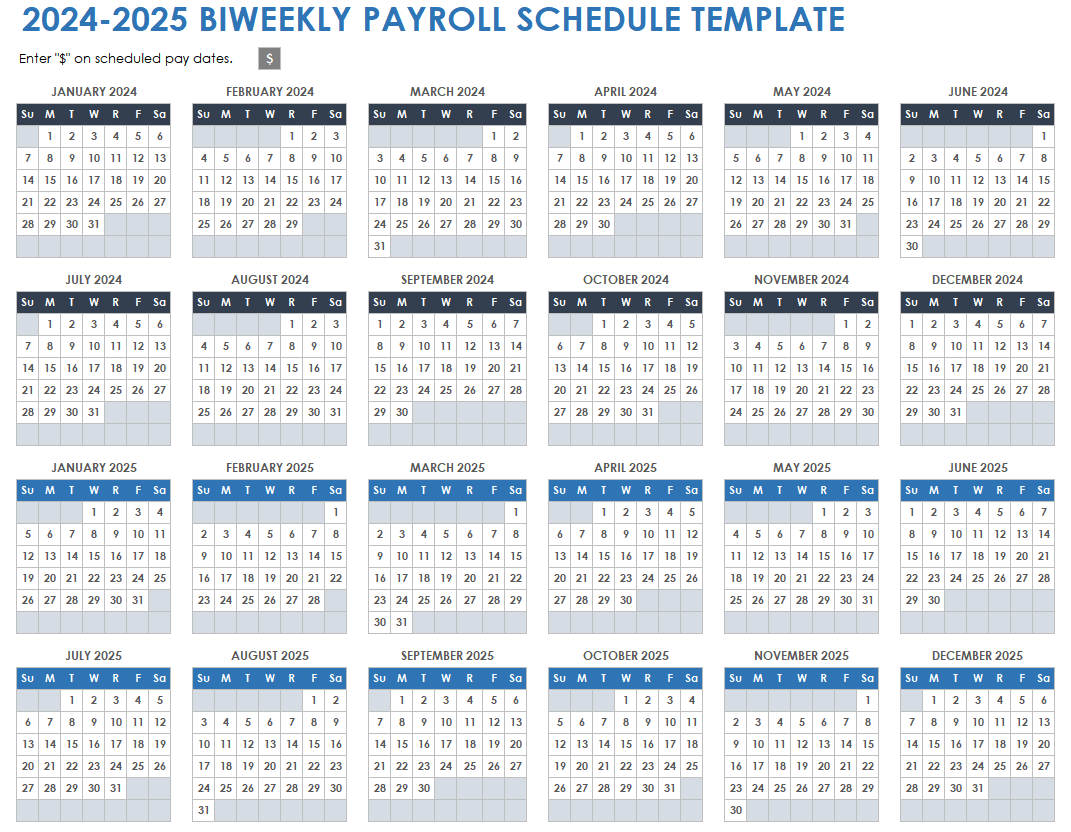

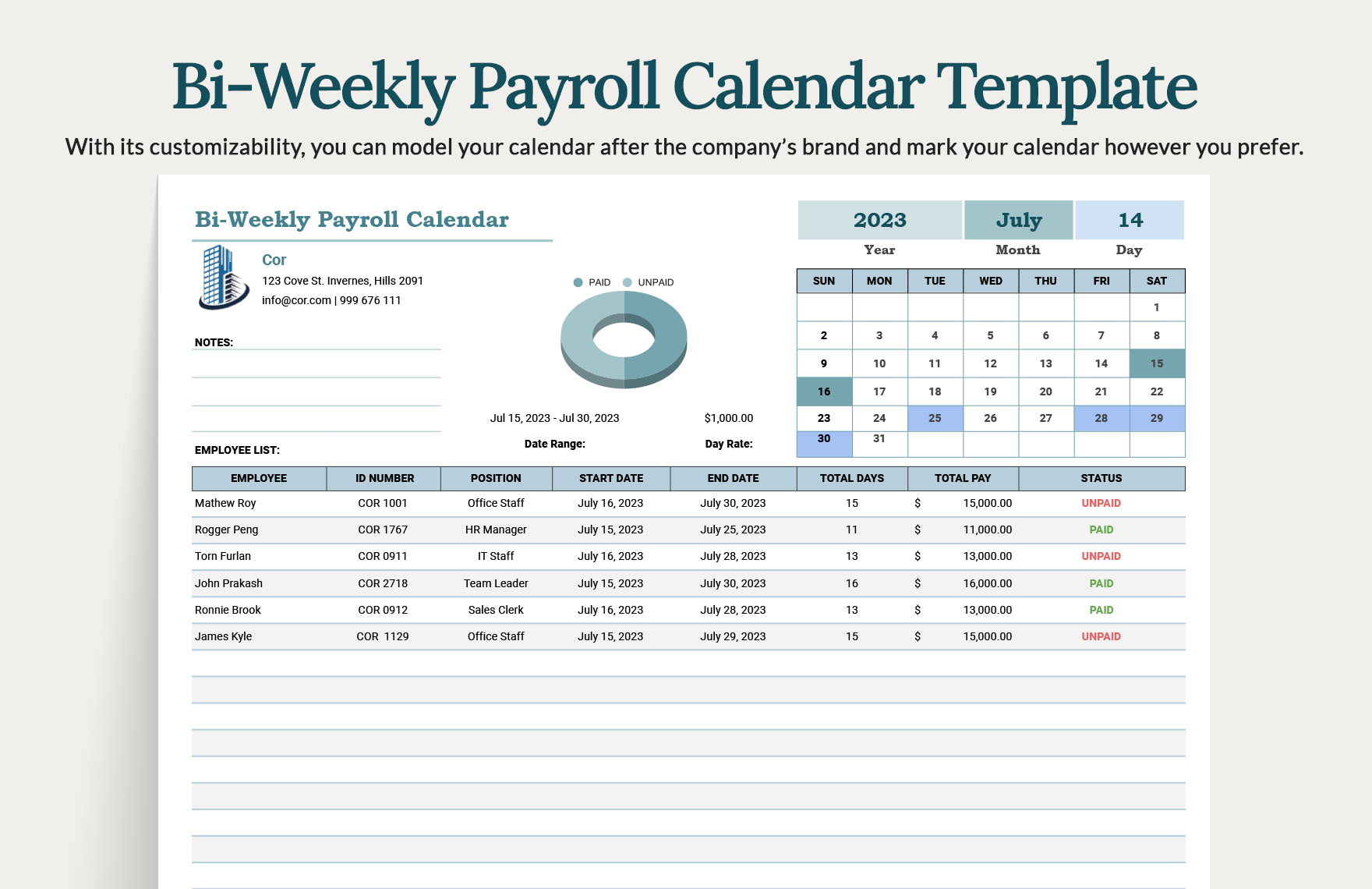

Establishing a Pattern 2025 Bi-Weekly Payroll Calendar:

For example, let’s assemble a pattern 2025 bi-weekly payroll calendar. We’ll assume a beginning payday of Friday, January third, 2025. This implies the pay interval covers the dates from December twenty first, 2024, to January third, 2025. Subsequent pay durations will observe a two-week interval. That is simply an instance; your organization’s calendar might differ based mostly on its particular wants and chosen begin date.

(Notice: The next calendar is a pattern and shouldn’t be used for precise payroll processing. All the time seek the advice of your payroll software program or a payroll skilled to find out correct fee dates.)

Pattern 2025 Bi-Weekly Payroll Calendar (Beginning January third, 2025):

| Pay Interval | Pay Interval Dates | Payday (Friday) |

|---|---|---|

| 1 | Dec 21, 2024 – Jan 3, 2025 | Jan 3, 2025 |

| 2 | Jan 4, 2025 – Jan 17, 2025 | Jan 17, 2025 |

| 3 | Jan 18, 2025 – Jan 31, 2025 | Jan 31, 2025 |

| 4 | Feb 1, 2025 – Feb 14, 2025 | Feb 14, 2025 |

| 5 | Feb 15, 2025 – Feb 28, 2025 | Feb 28, 2025 |

| 6 | Mar 1, 2025 – Mar 14, 2025 | Mar 14, 2025 |

| 7 | Mar 15, 2025 – Mar 28, 2025 | Mar 28, 2025 |

| 8 | Mar 29, 2025 – Apr 11, 2025 | Apr 11, 2025 |

| 9 | Apr 12, 2025 – Apr 25, 2025 | Apr 25, 2025 |

| 10 | Apr 26, 2025 – Might 9, 2025 | Might 9, 2025 |

| 11 | Might 10, 2025 – Might 23, 2025 | Might 23, 2025 |

| 12 | Might 24, 2025 – June 6, 2025 | June 6, 2025 |

| 13 | June 7, 2025 – June 20, 2025 | June 20, 2025 |

| 14 | June 21, 2025 – July 4, 2025 | July 4, 2025 |

| 15 | July 5, 2025 – July 18, 2025 | July 18, 2025 |

| 16 | July 19, 2025 – Aug 1, 2025 | Aug 1, 2025 |

| 17 | Aug 2, 2025 – Aug 15, 2025 | Aug 15, 2025 |

| 18 | Aug 16, 2025 – Aug 29, 2025 | Aug 29, 2025 |

| 19 | Aug 30, 2025 – Sep 12, 2025 | Sep 12, 2025 |

| 20 | Sep 13, 2025 – Sep 26, 2025 | Sep 26, 2025 |

| 21 | Sep 27, 2025 – Oct 10, 2025 | Oct 10, 2025 |

| 22 | Oct 11, 2025 – Oct 24, 2025 | Oct 24, 2025 |

| 23 | Oct 25, 2025 – Nov 7, 2025 | Nov 7, 2025 |

| 24 | Nov 8, 2025 – Nov 21, 2025 | Nov 21, 2025 |

| 25 | Nov 22, 2025 – Dec 5, 2025 | Dec 5, 2025 |

| 26 | Dec 6, 2025 – Dec 19, 2025 | Dec 19, 2025 |

(This desk continues till the tip of the 12 months. The sample will proceed with two-week intervals.)

Key Concerns for Employers:

- Payroll Software program: Using payroll software program is important for correct and environment friendly processing. These applications robotically calculate pay based mostly on hours labored, deductions, and tax obligations, minimizing guide errors.

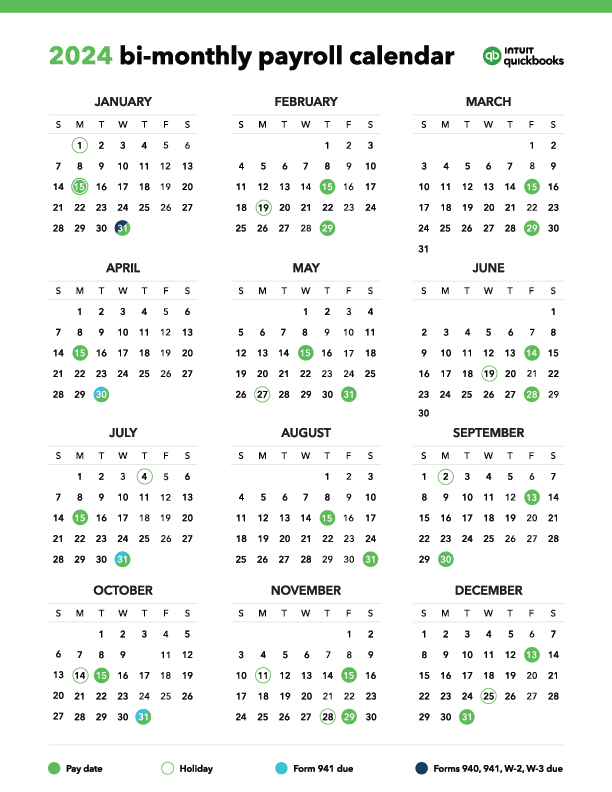

- Tax Compliance: Keep up to date on all federal, state, and native tax rules. Incorrect tax withholdings can result in vital penalties. Seek the advice of with a tax skilled if wanted.

- Time and Attendance Monitoring: Implement a dependable system for monitoring worker hours. Correct timekeeping is essential for correct payroll calculations.

- Direct Deposit: Providing direct deposit is handy for workers and streamlines the payroll course of for employers.

- 12 months-Finish Reporting: Put together for year-end payroll reporting necessities, together with W-2 preparation and submitting.

- Vacation Pay: Consider vacation pay and any extra compensation for workers engaged on holidays. Clearly talk vacation pay insurance policies to staff.

- Accrual of Paid Time Off (PTO): Precisely monitor and handle worker PTO accrual and utilization.

Key Concerns for Staff:

- Assessment Pay Stubs: Fastidiously assessment every pay stub to make sure accuracy in hours labored, deductions, and internet pay. Report any discrepancies to your employer promptly.

- Perceive Deductions: Familiarize your self with all deductions out of your paycheck, together with taxes, insurance coverage premiums, and another voluntary deductions.

- Budgeting: The constant bi-weekly pay schedule facilitates higher budgeting. Plan your bills accordingly based mostly in your common fee dates.

- Tax Planning: Perceive your tax obligations and plan accordingly all year long. Seek the advice of with a tax skilled if wanted.

- Communication: Keep open communication along with your employer concerning any payroll-related questions or considerations.

Conclusion:

A well-planned bi-weekly payroll system is important for each employers and staff. By understanding the intricacies of the calendar and adhering to finest practices, companies can guarantee clean monetary operations and preserve constructive worker relations. Whereas this text gives a pattern calendar and helpful insights, it is essential to do not forget that the particular dates will differ relying on the chosen place to begin and any company-specific changes. All the time seek the advice of along with your payroll supplier or a payroll skilled for correct and compliant payroll processing in 2025. Proactive planning and a spotlight to element will guarantee a profitable and stress-free payroll 12 months.

Closure

Thus, we hope this text has offered helpful insights into Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Staff. We hope you discover this text informative and helpful. See you in our subsequent article!