Navigating the Discretionary Gross sales Surtax Panorama: A 2025 Outlook

Associated Articles: Navigating the Discretionary Gross sales Surtax Panorama: A 2025 Outlook

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Navigating the Discretionary Gross sales Surtax Panorama: A 2025 Outlook. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Navigating the Discretionary Gross sales Surtax Panorama: A 2025 Outlook

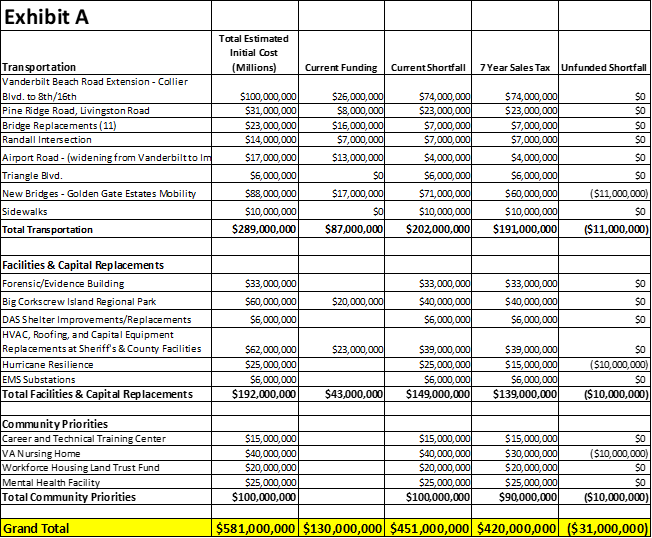

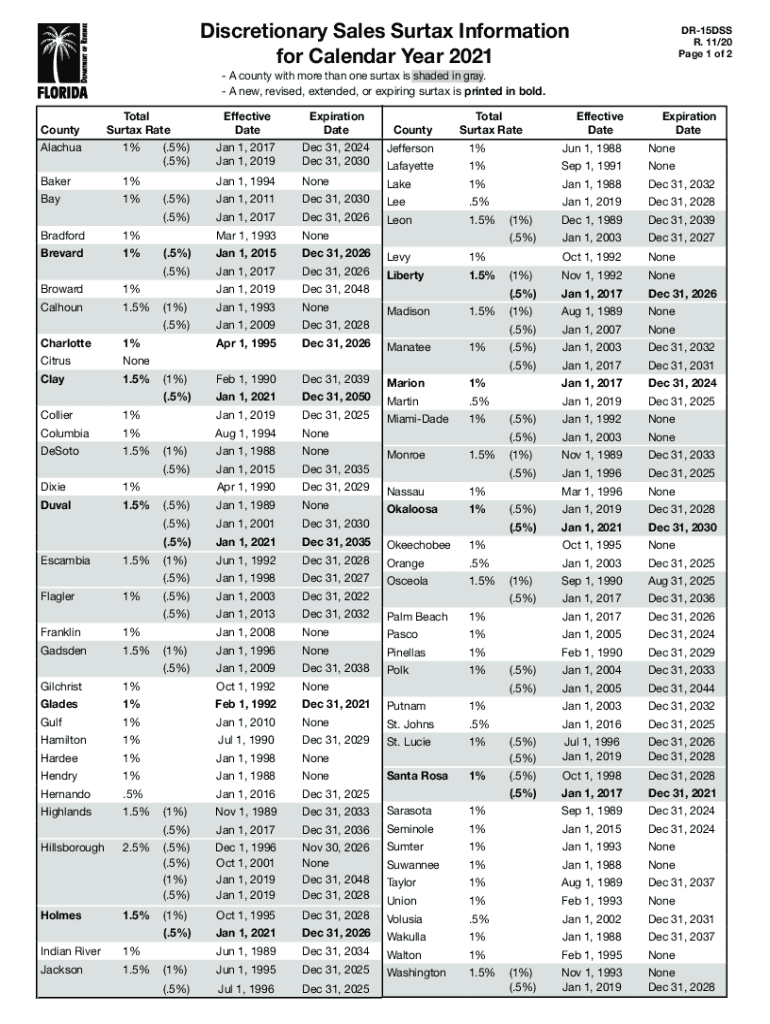

The 12 months 2025 is quick approaching, and with it, the potential for important modifications within the discretionary gross sales surtax panorama. Whereas particular laws varies extensively by jurisdiction, understanding the underlying rules and potential tendencies is essential for companies and shoppers alike. This text offers a complete overview of discretionary gross sales surtaxes, exploring their utility, potential future developments, and methods for navigating this complicated tax surroundings in 2025.

What are Discretionary Gross sales Surtaxes?

Discretionary gross sales surtaxes (DSSTs) are extra taxes levied on particular items and companies thought-about non-essential or discretionary. In contrast to normal gross sales taxes, which apply broadly to most purchases, DSSTs goal explicit product classes deemed prone to changes in client spending throughout financial fluctuations. This focused method permits governments to boost income whereas probably minimizing the influence on important items and companies. The particular objects topic to DSSTs differ considerably by location and are sometimes topic to political and financial concerns.

Key Traits of DSSTs:

- Focused Utility: DSSTs will not be levied on all gross sales however solely on pre-defined classes of products and companies. This focused nature distinguishes them from broader gross sales taxes.

- Income Technology: The first objective of DSSTs is to generate income for presidency applications and initiatives. This income might be allotted to particular tasks or contribute to normal fund balances.

- Financial Sensitivity: The objects topic to DSSTs are sometimes these thought-about discretionary, which means their consumption might be simply adjusted primarily based on financial situations. This permits for some income stabilization throughout financial downturns.

- Jurisdictional Variation: The appliance and charges of DSSTs differ considerably by state, county, and even municipality. This creates a fancy and fragmented tax panorama requiring cautious consideration to element.

- Potential for Change: DSSTs are incessantly topic to legislative modifications, reflecting evolving financial priorities and political concerns. This requires ongoing monitoring and adaptation.

Potential Traits for DSSTs in 2025:

Predicting the exact state of DSSTs in 2025 requires cautious consideration of assorted elements, together with financial forecasts, political landscapes, and client habits. Nonetheless, a number of tendencies are prone to form the panorama:

-

Elevated Deal with Digital Items and Providers: Because the digital financial system continues its enlargement, we will count on to see elevated consideration paid to the taxation of digital items and companies. This might contain the enlargement of current DSSTs to embody digital downloads, streaming subscriptions, and on-line gaming companies. The challenges of cross-border taxation and constant utility throughout completely different platforms shall be important points.

-

Environmental Concerns: Governments are more and more incorporating environmental considerations into their tax insurance policies. This may result in the introduction or enlargement of DSSTs on items deemed environmentally unfriendly, akin to single-use plastics, high-emission automobiles, or energy-intensive merchandise. This displays a rising emphasis on sustainable consumption patterns.

-

Inflationary Pressures and Income Wants: Excessive inflation charges can considerably influence authorities income. This might result in will increase in current DSST charges or the introduction of latest surtaxes on items and companies at present exempt. The political feasibility of such will increase shall be a key determinant.

-

Fairness Issues: Issues about fairness and equity in taxation may result in debates concerning the influence of DSSTs on lower-income households. This might lead to changes to the scope of DSSTs to exclude important items or companies disproportionately affecting susceptible populations.

-

Technological Developments in Tax Assortment: Technological developments in tax assortment, akin to AI-powered programs and blockchain expertise, may streamline the administration and enforcement of DSSTs. This might enhance compliance and scale back administrative prices for each governments and companies.

Navigating DSSTs in 2025: Methods for Companies:

Companies working in jurisdictions with DSSTs must undertake sturdy methods to make sure compliance and decrease tax liabilities. Key methods embody:

-

Keep Knowledgeable: Intently monitor legislative modifications and updates concerning DSSTs on the native, state, and federal ranges. Subscribe to related tax newsletters and seek the advice of with tax professionals to remain abreast of the newest developments.

-

Correct Tax Calculation and Reporting: Implement correct and environment friendly programs for calculating and reporting DSSTs. Make the most of tax software program and seek the advice of with tax advisors to make sure compliance with all relevant laws.

-

Stock Administration: Keep correct stock data to correctly monitor the taxable standing of products and companies topic to DSSTs. That is essential for correct tax calculation and reporting.

-

Pricing Methods: Develop pricing methods that account for DSSTs. This may contain incorporating the tax into the value or clearly displaying the tax individually. Transparency is essential to sustaining buyer belief.

-

Tax Planning: Have interaction in proactive tax planning to attenuate DSST liabilities. This may contain exploring potential deductions, credit, or exemptions out there underneath relevant laws.

-

Put money into Expertise: Make the most of expertise to automate tax calculations, reporting, and compliance processes. This could considerably enhance effectivity and scale back the danger of errors.

Navigating DSSTs in 2025: Methods for Shoppers:

Shoppers must also pay attention to DSSTs to make knowledgeable buying selections. Methods embody:

-

Perceive the Tax: Concentrate on which items and companies are topic to DSSTs in your jurisdiction. This permits for knowledgeable budgeting and buying selections.

-

Evaluate Costs: Evaluate costs throughout completely different retailers to establish potential financial savings. Some retailers could take up the DSST whereas others could move it on on to the buyer.

-

Store Strategically: Alter buying habits to attenuate the influence of DSSTs. This may contain delaying non-essential purchases or substituting items and companies not topic to the surtax.

-

Keep Knowledgeable: Maintain abreast of modifications in DSSTs to regulate spending habits accordingly.

Conclusion:

The discretionary gross sales surtax panorama in 2025 will doubtless be formed by evolving financial situations, technological developments, and evolving political priorities. Companies and shoppers should stay vigilant, proactively adapt to modifications, and leverage out there sources to navigate this complicated tax surroundings successfully. Understanding the underlying rules, potential tendencies, and out there methods is essential for profitable monetary planning and compliance within the years to return. Consulting with tax professionals and staying knowledgeable about legislative modifications are important steps in mitigating dangers and maximizing alternatives throughout the dynamic world of discretionary gross sales surtaxes. The knowledge supplied on this article is for normal informational functions solely and doesn’t represent authorized or monetary recommendation. It’s essential to seek the advice of with certified professionals for recommendation tailor-made to your particular circumstances.

Closure

Thus, we hope this text has supplied worthwhile insights into Navigating the Discretionary Gross sales Surtax Panorama: A 2025 Outlook. We hope you discover this text informative and helpful. See you in our subsequent article!